New Gas Investment Blocks to Undergo Reassessment Amid Slow Reserve Growth

New Gas Investment Blocks to Undergo Reassessment Amid Slow Reserve Growth

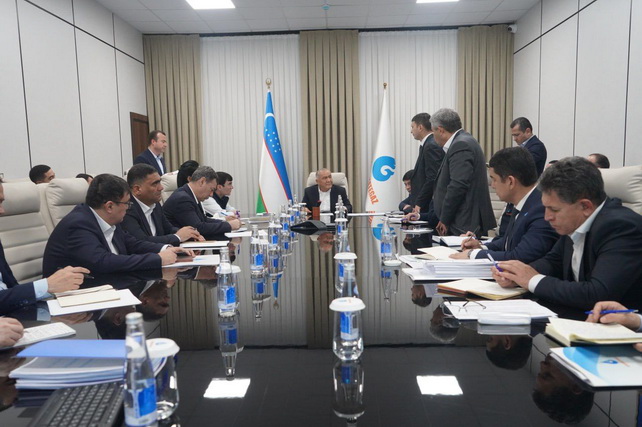

Tashkent, Uzbekistan (UzDaily.com) — The primary factor limiting sustainable growth in natural gas production in Uzbekistan remains the insufficient increase in newly discovered reserves, according to a meeting chaired by Abdulgani Sanginov, head of Uzbekneftegaz.

The company’s press service noted that, despite transferring most promising investment blocks to private investors, geological exploration has been progressing extremely slowly. To address this issue, a reassessment of 31 investment blocks in the Surkhandarya, Gissar, and Ustyurt regions will be conducted, targeting areas where reserve growth has not been achieved. Additionally, several sites currently under the Ministry of Geology will be transferred under the management of Uzbekneftegaz. The plan calls for the preparation of 30 new prospective sites annually during 2026–2027.

A second priority is a strict review of private operators’ performance. The company intends to reassess underperforming investors and replace them through open tenders. To encourage investment in complex fields, technical and economic justifications will be developed, and starting gas prices will be established, creating transparent and predictable conditions for investors.

The President has set an ambitious target for the sector — to increase daily gas production from 66 to 70 million cubic meters in 2026. Achieving this goal will involve 149 geological and technical operations, drilling 70 new wells, major repairs of 40 wells, and conducting 3D seismic surveys over 6,500 square kilometers.

The meeting emphasized improving production efficiency, adopting modern technologies, and intensifying geological exploration. The President reiterated the need for strict measures against theft and corruption in the sector, as well as full utilization of processing plant capacities through increased reserves and production volumes.

Financial rehabilitation has become a central part of the reforms. Dividend payments are to be directed toward geological exploration, product sales will be conducted through open exchange auctions, and prices for processing services by private companies will follow market principles. The use of funds for sponsorship or unrelated expenses will be prohibited, ensuring financial resources are focused on the sector’s key priorities.

To enhance transparency and reduce theft, oil depots and pipeline systems will be integrated into digital SCADA platforms and other control systems. Fuel sales will require 100% prepayment, which, combined with reduced accounts receivable, will strengthen financial discipline and oversight by law enforcement agencies.

Each presidential directive will be strictly monitored until full documentary confirmation of its implementation, increasing personal accountability for industry leaders and ensuring the achievement of the set objectives.